Click to read the article in Turkish / Kurdish

The main opposition Republican People's Party (CHP) and Peoples' Democratic Party (HDP) have submitted legislative proposals regarding the fuel oil prices in Turkey amid recent price increases.

While the Economy Commission of the HDP has requested that the Value Added Tax (VAT) and Special Consumption Tax levied on fuel oil be abolished, CHP İzmir MP Murat Bakan has requested that these two taxes not be levied on fuel oil used in public transport.

In their proposal, HDP MPs Garo Paylan, Necdet İpekyüz, Erol Katırcıoğlu and Serpil Kemalbay have raised concerns over sharp increases in the prices of gasoline and diesel and the effects of these price hikes on citizens. The MPs have argued that "by using the Russia-Ukraine war as a pretext, the government has been increasing fuel oil prices almost everyday."

According to the HDP, while the fuel oil prices have seen an average of 60-percent increase in global markets in the last six months, this rate is 160 percent for gasoline and 220 percent for diesel fuel in Turkey. The MPs have recalled that a liter of gasoline now costs more than 20 lira and a liter of diesel costs over 23 lira after the recent price hikes.

"Lorry, bus, minibus and taxi drivers and especially farmers have been lashing out at fuel oil costs," the MPs have stressed, saying that "farmers can no longer plow and lorry drivers can no longer carry loads."

The MPs have warned that "if prices remain at this level, it will lead to a further aggravation of the food crisis and the economic crisis".

They have further emphasized that the increases in fuel prices lead to increases in the prices of all products, from the string to the needle, noting that "the exorbitant increases in fuel prices will manifest themselves as high inflation and low purchasing power" on the part of citizens.

Underlining the obligation of the Parliament to assume responsibility in this picture, the HDP Economy Commission has requested that the VAT and Special Consumption Tax levied on fuel oil be reduced to zero, which will mean a nearly 6-lira decrease in prices per liter.

Motion by CHP for public transport

Main opposition CHP İzmir MP Murat Bakan has also submitted a legislative proposal and requested that the Value Added Tax (VAT) and Special Consumption Tax levied on the fuel used in public transport be abolished by amending the laws on VAT and Special Consumption Tax.

In his legislative proposal, Bakan has said, "Our citizens have become so poor that they can no longer meet their most basic human needs, including food, which are guaranteed by Constitution; they cannot exercise their most essential right to travel such as going to school or work."

24 percent of fuel oil prices: Tax

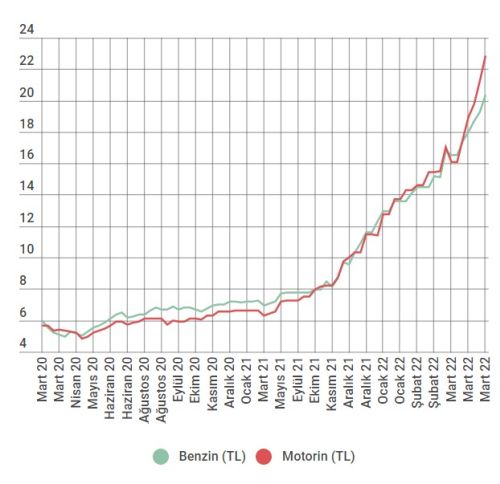

* Changes in fuel oil prices in Turkey from March 2020 to March 2022 (Green: Gasoline (TRY) - Red: Diesel Fuel (TRY))

The Brent crude and USD/TRY parity were as follows at given dates:

- November 1: 68 USD (USD/TRY 9.53)

- December 1: 77 USD (USD/TRY 13.26)

- January 1: 89 USD (USD/TRY 13.31)

- February 1: 97 USD (USD/TRY 13.36)

- Now: 130.5 USD (USD/TRY 14.46)

As of March 10, the Value Added Tax (VAT) and Special Consumption Tax account for 24.01 percent of the fuel oil prices in Turkey. (HA/SD)