Photo: Public Domain Pictures

Click to read the article in Turkish

Turkey's large external financing needs and relatively low reserves leave it vulnerable to shocks, the International Monetary Fund (IMF) said in its External Sector Report evaluating the 29 largest economies in the world and the Euro zone countries.

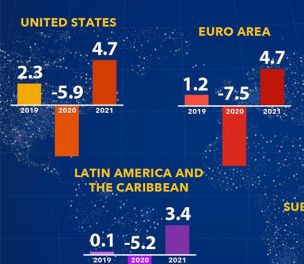

The Covid-19 pandemic has caused a sharp reduction in trade and significant movements in exchange rates, the report noted and added that "The outlook remains highly uncertain as the risks of new waves of contagion, capital flow reversals, and a further decline in global trade still loom large on the horizon."

The report assessed Turkey's external position in 2019 "moderately stronger than the level implied by medium-term fundamentals" despite "high uncertainties."

"This assessment reflects the lagged adjustment of external balances following the sharp depreciation of the real exchange rate in 2018, which is projected to unwind over time," says the report. "Large external financing needs and relatively low reserves leave Turkey vulnerable to shocks."

IMF suggested "structural reforms" for Turkey to increase its resilience against shocks:

"In the near term, policies need to cushion the impact of the Covid-19 crisis and protect the most vulnerable through temporary and targeted fiscal support, preferably within a policy package that would help secure greater external stability.

"If imbalances that existed prior to the Covid-19 outbreak persist in the medium term, policies should aim to strengthen external resilience and support a sustainable rebalancing of the economy.

"Monetary policy, supported by efforts to rein in rapid credit growth, would aim to reduce inflation durably and strengthen central bank credibility while rebuilding reserves.

"Focused structural reforms would be necessary to enhance productivity, increase resilience to shocks, and strengthen the broader public sector balance sheet and improve transparency in general. These could include efforts to bolster the business climate, including by further strengthening Turkey's insolvency and corporate restructuring frameworks." (HA/VK)

as.jpg)