Finance Minister Mehmet Şimşek has announced a new incentive regulation aimed at encouraging foreign currency inflows into Turkey. The regulation is part of the government’s efforts to stabilize the lira, rein in inflation, and restore investor confidence under the leadership.

According to the regulation, the tax reduction and exemption rates applied to some activities of income and corporate tax payers abroad will be increased, provided that the earnings are brought into Turkey, said Şimşek.

The minister added that they would soon submit a proposal to the parliament, encompassing the mentioned regulation.

Highlighting the prioritization of certain aspects of the initiative, Şimşek remarked, “To encourage the inflow of foreign currency into our country, we will increase the tax reduction and exemption rates applied to the activities of income and corporate tax payers abroad, on the condition that the earnings are brought into the country.

“For the support of exports, we will apply a 5-point corporate tax reduction to the gains related to the activities of manufacturing and supplying exporters.”

.jpg)

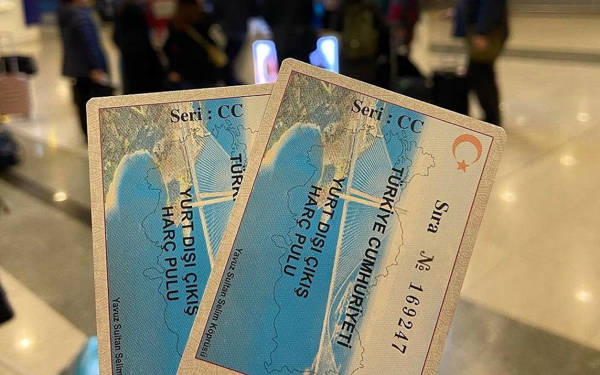

The cost of exiting the crisis for Turkey

The application will be valid for the export activities carried out by manufacturing or supplying institutions through foreign trade capital companies or sectoral foreign trade companies based on intermediary export contracts.

“We are raising the 50% profit exemption provided for income obtained from services offered abroad, such as architecture, engineering, software, design, data processing, call services, education, and health activities, to 80% on the condition that the earnings are brought to Turkey,” Şimşek furher said. “Thus, we are reducing the tax burden for these gains to 5% for corporate tax payers.”

Şimşek also expressed that income and corporate tax payers would be exempted from 50% of these gains, provided that the entire profit from dividends obtained abroad is brought into Turkey.

Background

Turkey’s economy, which was one of the few big economies that managed to grow in 2020, has faced multiple challenges since 2021, including the COVID-19 pandemic, rising energy prices, frequent changes in the monetary policy, and a series of interest rate cuts that sent the lira dropping to historic lows and inflation soaring to record highs. These challenges have eroded real incomes for the poorer households, increased the private sector debt, widened the current account deficit, and undermined the fiscal position of the country.

Following the May elections, President Recep Tayyip Erdoğan named former economy chief Mehmet Şimşek as his new treasury and finance minister, in a move that was seen as a sign of policy orthodoxy and market friendliness.

Mehmet Şimşek, as the Finance Minister, has implemented a series of impactful measures to address and navigate through Turkey's economic challenges. One notable action was the adjustment of the policy interest rate, which saw a substantial increase from 8.5% to 35%. This decision aimed to stabilize the Turkish lira and counter the record-high inflation of 61.36% in October 2023.

In his pursuit of fiscal health, Şimşek introduced strategic tax hikes on essential sectors such as fuel, motor vehicles, tobacco, and alcohol. These adjustments were designed to bolster fiscal revenues and mitigate budget deficits, contributing to a more robust financial position for the government.

Recognizing the need to align credit growth with inflation targets, particularly in consumer loans like credit cards, housing, and vehicles, Şimşek implemented limitations. This prudent credit management approach aimed to alleviate domestic demand pressures and foster a sustainable economic environment. (VK)