The claimed 694-million-ton rare earth element (REE) reserves in Beylikova, Eskişehir, have remained in the spotlight since the meeting between US President Donald Trump and Turkish President Recep Tayyip Erdoğan on Sep 25.

On October 7, Republican People’s Party (CHP) leader Özgür Özel, speaking at his party’s parliamentary group meeting, alleged that Erdoğan had granted the U.S. the right to exploit these reserves, criticizing the government with the statement: “Turkey must stand up regarding its REEs; Erdoğan cannot sell this country’s rare elements for his own future.” The Communications Directorate, however, denied claims that the reserves had been handed over to the U.S.

REEs are critically important for technology and defense industries. In a May 2025 analysis, the National Intelligence Academy noted that REEs are no longer merely an economic commodity but have become “a geopolitical lever and strategic weapon.”

The United States and European Union countries are seeking alternative sources because 60% to 70% of these elements are currently supplied by China. Turkey, with the potential reserves in Beylikova, is emerging as a possible alternative route in this strategic market.

Experts who spoke to bianet, but requested anonymity, said that the site in Eskişehir is under tight security measures comparable to those at the Akkuyu Nuclear Power Plant (NPP).

The site is almost completely closed to access and inspection; only invited personnel are allowed to participate in operations. Experts note that security may have been heightened because radioactive elements such as thorium and uranium are present during the processing of rare earth elements (REEs).

Why REEs matter to the U.S.

REEs first came onto the U.S. agenda in 2017–2018. In particular, during the 2018 “trade war” discussions with China, REEs were highlighted as critical for the U.S.’s strategic and economic independence.

President Trump emphasized that China’s monopoly over global REE production and processing capacity could be used to exert potential pressure on the U.S., and he repeatedly stressed the need for alternative sources.

During his second term, on May 8, 2025, Trump announced the formal signing and enactment of a rare earth element agreement between the U.S. and Ukraine. The deal was framed as part of the U.S. strategy to support Ukraine against Russia while reducing dependence on China. Under the agreement, the U.S. gains priority access to Ukraine’s critical resources, including REEs, lithium, titanium, and uranium.

The agreement is also linked to a potential ceasefire in the Russia-Ukraine conflict. Ukrainian President Zelenski had stated that Russia would not accept a ceasefire without concessions, but after three months of diplomatic contacts, Ukraine indicated readiness to engage in peacekeeping discussions. This arrangement safeguards U.S. commercial interests while allowing Russia to maintain positions in strategic regions such as Donetsk and Crimea. Some of Ukraine’s REE sites are effectively under Russian control, meaning the agreement can also be interpreted as an indirect “sharing of Ukraine’s REEs” between the U.S. and Russia.

“They are critical even if used in small quantities”

At a time when the U.S. is strengthening its rare earth element (REE) strategy, work at Beylikova—cited as “the world’s second-largest reserve site”—has become the focus of debate.

An expert who has studied Beylikova closely and worked on REEs for years explained the importance of the Beylikova ore as follows:

“The Beylikova ore—formerly called Beylikahır before the name was changed—contains rare earth elements. It also includes small amounts of thorium and uranium. Its structure is quite complex. In addition to thorium and uranium, barite and fluorite are present. REEs are particularly important for the information technology sector, space technologies, and the defense industry. Even though they are used in small quantities, they occupy a critical position.

“In Turkey, the process of identifying these reserves began during the era of the General Directorate of Mineral Research and Exploration (MTA), after which the site was transferred to Eti Maden Enterprises. A few years ago, reports were published indicating the discovery of substantial reserves.

“According to these reports, the reserve at Beylikova amounts to 694 million tons. The official source for these figures is Eti Maden Enterprises itself. The accuracy of the reserve values is based on drilling studies and has been formalized in reports. However, we cannot make a definitive judgment on their actual presence or absence, because the current political structure and practices can pave the way for reckless initiatives that waste mineral resources. Precious metals are sometimes allocated to favored companies, while resources are transferred to others.”

Difference between measured and probable reserves

Metallurgical engineer Cemalettin Küçük explained that measured reserves represent the economically valuable quantity of a deposit, while probable and possible reserves are based on estimates. He emphasized that they do not have access to the relevant data because MTA records were transferred to companies after 2005 and are no longer publicly available.

“Measured reserves are calculated when the ore body is identified in the field. At this stage, we measure its width, length, and depth, multiply by density, and determine the quantity of valuable elements it contains. Only measured reserves can be considered economically viable. Probable reserves refer to the next estimate where the width and length are largely known, and the depth is estimated. Possible reserves are determined through similar methods but represent a more uncertain quantity. Potential reserves are based solely on inferred similarities—for example, estimates made when Turkey was thought to have a total of 6,500 tons of gold—and have not yet been confirmed in the field. These reserves are recorded as scientific data but do not hold economic value. Today, with technological advances, estimates for probable and possible reserves can be made with much greater precision.”

“MTA data now in the hands of companies”

“About 30 years ago, despite technologies that did not exist at the time, the General Directorate of Mineral Research and Exploration (MTA) had identified reserves in Turkey and mapped them at a 1:25,000 scale. While access to these maps and data sets used to be possible, after the 2005 legal changes, the data began to be sold to companies and is no longer publicly available. MTA’s roughly 90 years of fieldwork and reserve identification have been transferred to private firms. Whereas researchers once could obtain information from databases and reports at low cost, today access is possible only for high fees. This situation severely limits transparency, especially for strategic minerals like rare earth elements and gold.

“Fieldwork and mineral identification were once meticulously recorded; today, even advanced technological surveys provide little public benefit when compared with older data. Although the existence and identification of sites defined as ‘Zuhur’ are known, the lack of updated data prevents the public and researchers from accessing information.”

“Turkey can process its own REEs”

An expert who requested anonymity noted that the state’s preference for selling resources rather than taking a public-sector approach has negatively affected the processing of REEs. The expert emphasized that, with proper planning and effective oversight, Turkey could become a strategic producer using its own capabilities:

“The processes for REEs are highly complex, multi-stage, and critical. In a 2023 doctoral study, the researcher obtained four rare earth elements—cerium, lanthanum, scandium, and niobium—in their final metallic form. This requires specific know-how, so I disagree with those who claim it is impossible in Turkey. The country can use its own resources, local expertise, and trained specialists to process these elements and participate in the market as a producer. Of course, producing REEs requires substantial financial investment, and making large-scale investments is not easy. However, the state currently prefers selling the resources rather than managing production. With proper planning and investments under state oversight, Turkey could process its own resources domestically and emerge as a strategic producer.

“A few years ago, the Turkey Energy, Nuclear, and Mining Research Agency (TENMAK) was established directly under the Presidency, which includes a new unit called NATEN (Rare Earth Elements Research Institute) focused on REE assessment. NATEN has only been operating for two to three years, aiming to institutionalize research and development activities in this field. Long-established institutions, such as BOREN (National Boron Research Institute), have also been integrated into this structure.”

“There’s a tendency to overvalue anything that will bring money”

According to the expert, although Turkey holds roughly two-thirds of the world’s boron reserves, its economic return remains far below potential because it has not been sufficiently integrated into the value-added product chain:

“The presence of official institutions theoretically indicates that Turkey has a public-sector infrastructure capable of conducting research. However, who is included in these institutions is debatable: there are criticisms that political preferences often outweigh merit in practice. Studies conducted in April under the Ministry of Energy and Natural Resources also show that, as in many countries, ‘critical and strategic raw materials’ are on Turkey’s agenda; yet the lack of engineering organizations and academic experts in the field is notable. Institutional structures generally consist of people with similar mindsets aligned with their own perspectives. As a result, studies that transparently inform and convincingly guide the public are rare. For example, the statement ‘Turkey holds 73% of the world’s boron reserves’ is frequently repeated, but because the country is not sufficiently active in the value-added production chain, its economic return is far below potential. Therefore, it’s not just the size of the resource that matters—qualified personnel, independent academic contributions, and effective R&D structures are also decisive.

“The issue is not solely financial; there is also a structural distortion. There is a tendency to overvalue and market anything that can generate revenue. The current political structure makes this almost inevitable: the government has a serious need for financial resources because investment is not flowing into the country. As a result, they want to rapidly market all available resources and justify this as a legitimate approach. Current political and economic trends increase pressure to quickly hand over resources to private actors, making long-term, public-interest-oriented evaluation difficult. The solution is simple: the exploration and operation of Beylikova and similar REE sites should remain under public oversight, as with boron, and legal regulations should prevent their transfer to private interest groups. This would both protect strategic resources and increase the chances of generating real value through merit, transparency, and scientific methods.”

U.S. and EU perspectives on Turkey

The expert also commented on how U.S. and EU sources view Turkey’s position in global supply chains:

“It seems that U.S. sources are positioning Turkey strategically within the supply chain. Regardless of the ups and downs shown in various charts, ultimately performance is evaluated based on what was done during elections. There’s a business-minded approach; the country is managed like a company, and the system in the U.S. is similar. However, as I have often noted, these processes frequently remain incomplete or are portrayed as less effective than they actually are. High initial targets and big promises are made, but structural deficiencies, political interventions, and appointments lacking merit often mean results fall short of expectations. Therefore, it is very difficult for such institutions to produce work that transparently informs the public and inspires confidence.

“The same expectations existed when BOREN (National Boron Research Institute) was established. What happened afterward? Boron-based detergents or similar products. While it is possible to contact the established institutes to obtain information on these processes, the information we get often raises more questions than it answers.

“The Ministry of Energy and Natural Resources’ Turkey Critical and Strategic Minerals Report shows similar problems. The report contains serious uncertainties. The basis for its calculations is unclear; 37 mineral resources are divided into three different strategic categories, but only two of these rely on reliable data sources—one from defense industry information, the other from the ministry’s own report. The report does not utilize academics, relevant institutions, or experienced groups, which is a major shortcoming. In Turkey, there are many scholars, institutions, and relevant groups you could consult and use as sources in preparing such a report, yet it seems none were consulted.”

Beylikova and the 694 million-ton reserve claims

Turkey’s REE reserves have been identified since the late 1950s. The country’s largest REE deposit is in Eskişehir, particularly rich in lanthanum, cerium, and neodymium. The second-largest reserve is in Çanaklı, Isparta, and additional NTE deposits exist in Malatya.

The Beylikova REE deposit was first brought into the spotlight by then-Minister of Energy and Natural Resources, Fatih Dönmez. In July 2022, speaking at ETİMADEN’s Beylikova Fluorite, Barite, and Rare Earth Elements Operations Directorate, Dönmez described Eskişehir as facing “a discovery that will go down in history” and said:

“In the six years of exploration starting in 2011, we drilled a total of 125,193 meters and collected 59,121 samples. Analyses of these samples resulted in the discovery of 694 million tons of rare earth elements. With this discovery, it became the world’s second-largest REE reserve.”

With this announcement, the reserve—containing 17 different rare earth elements—was recorded as the world’s second-largest after China’s 800 million-ton reserve.

Turkey’s rare earth element ambitions

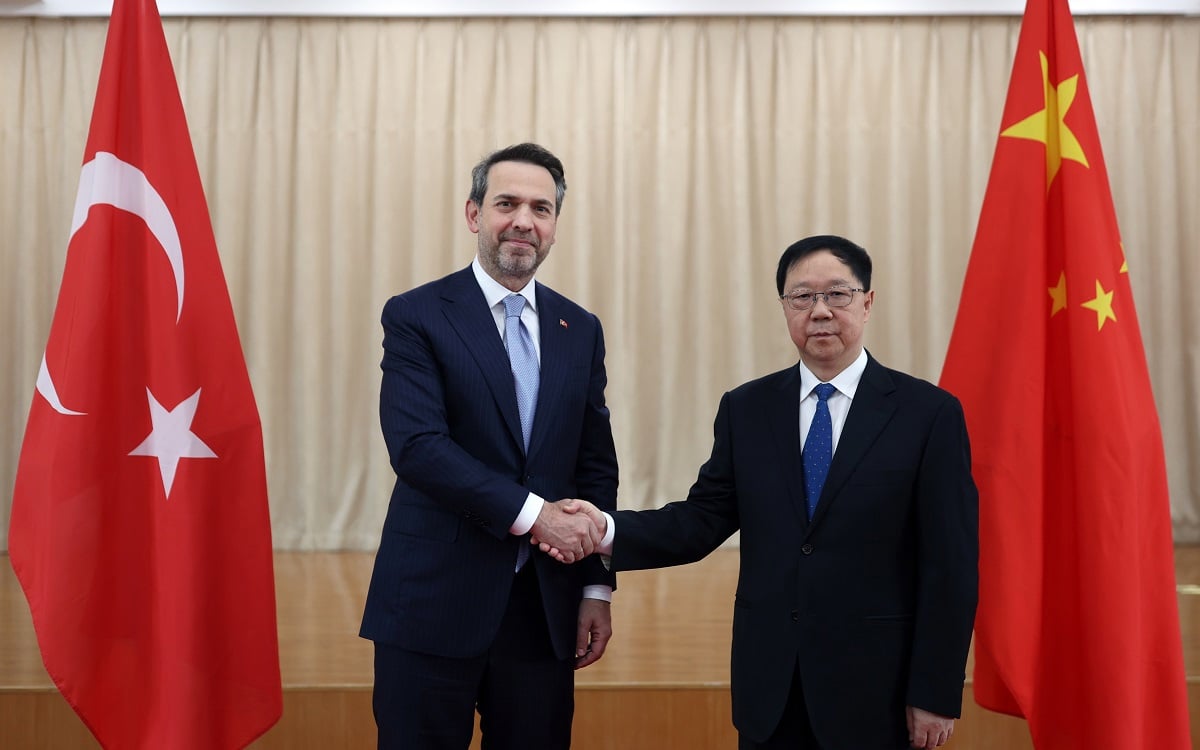

Energy and Natural Resources Minister Alparslan Bayraktar said in December 2023 that Turkey aims to become a major player in electric vehicle and renewable energy technologies through rare earth element (REE) production.

“Turkey will be one of five countries capable of producing REEs and will become an important global supplier. There is approximately 690 million tons of ore here. We initially established a pilot facility to process this resource, which was inaugurated by the President last April. In the first phase, we will process 1,200 tons of ore. Based on the results from this facility, we plan to build an industrial plant capable of processing 570,000 tons of ore annually and producing about 10,000 tons of rare earth oxides per year,” Bayraktar said.

In this context, the Memorandum of Understanding on Cooperation in Natural Resources and Mining was signed in October 2024 by Bayraktar and his Chinese counterpart Wang Guanghua. Commenting on the agreement, Bayraktar stated: “We aim to advance our cooperation in all areas of mining, particularly on critical minerals, and to work together in Turkey.”

What are REEs and why are they important?

Rare earth elements (REEs) consist of 17 elements: 15 lanthanides plus yttrium and scandium, sharing similar chemical, magnetic, and optical properties. REEs are crucial for modern technology, defense industries, and industrial applications.

REEs are classified as heavy (Y, Eu, Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu) or light (Sc, La, Ce, Pr, Nd, Pm, Sm) based on atomic numbers and natural abundance. Light REEs are more common in nature. The term “rare” does not indicate scarcity in the Earth’s crust but refers to the difficulty of extracting and processing them. Some REEs are more abundant than metals such as chromium, nickel, lead, or copper.

Because of their unique properties, REEs are essential additives in modern materials and energy technologies. While used in small quantities by weight, they significantly enhance mechanical, magnetic, electrical, and optical performance—earning them nicknames like the “vitamins” or “seeds” of materials. Common applications include magnets and alloys.

REEs are particularly critical in producing SmCo and NdFeB magnets, which are used in electric motors and wind turbines. The demand for REEs in next-generation wind turbines is increasing steadily.

In defense applications, REEs are used in radar, sonar, communication systems, missile and jet engines, night vision devices, lasers, and precision sensors. They also serve as catalysts in industrial processes, additives in glass, ceramics, polymers, and alloys, and in medical and research fields such as MRI contrast agents and nuclear technology. For these reasons, REEs are of both economic and strategic importance in high-tech, defense, and energy transition sectors.

Sources: Associated Press, NTE Process, Ministry of Energy and Natural Resources, Global Policy Watch, Anadolu Agency.

(TY/VC/MH)