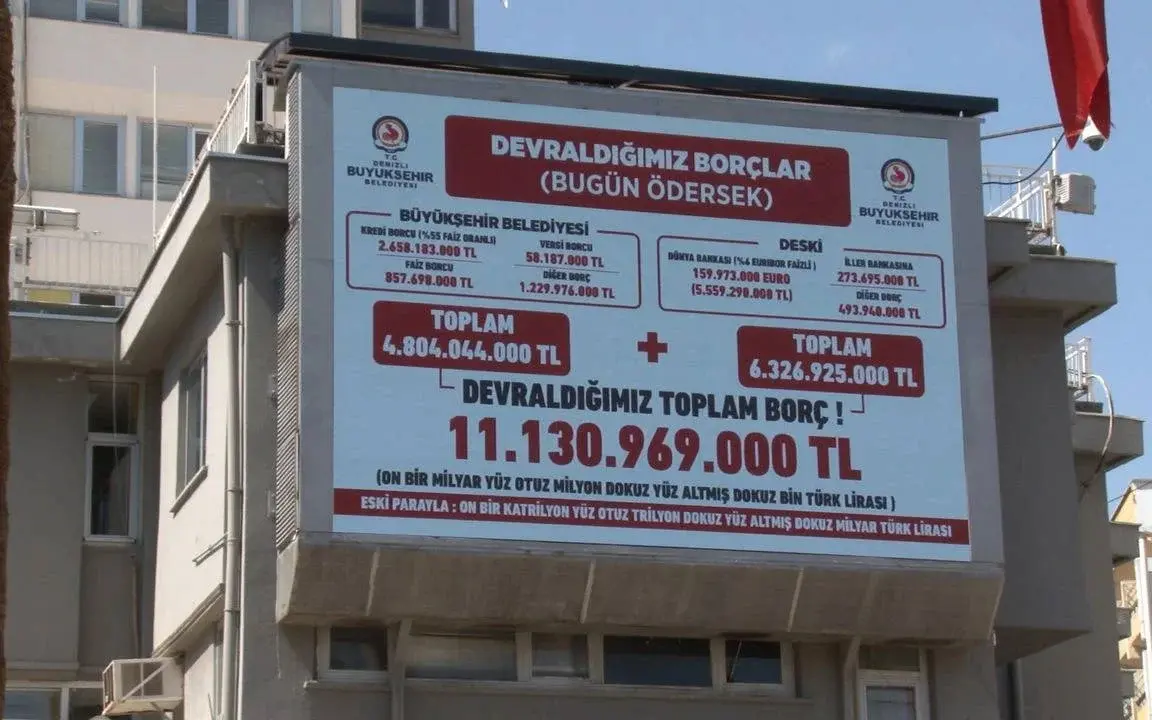

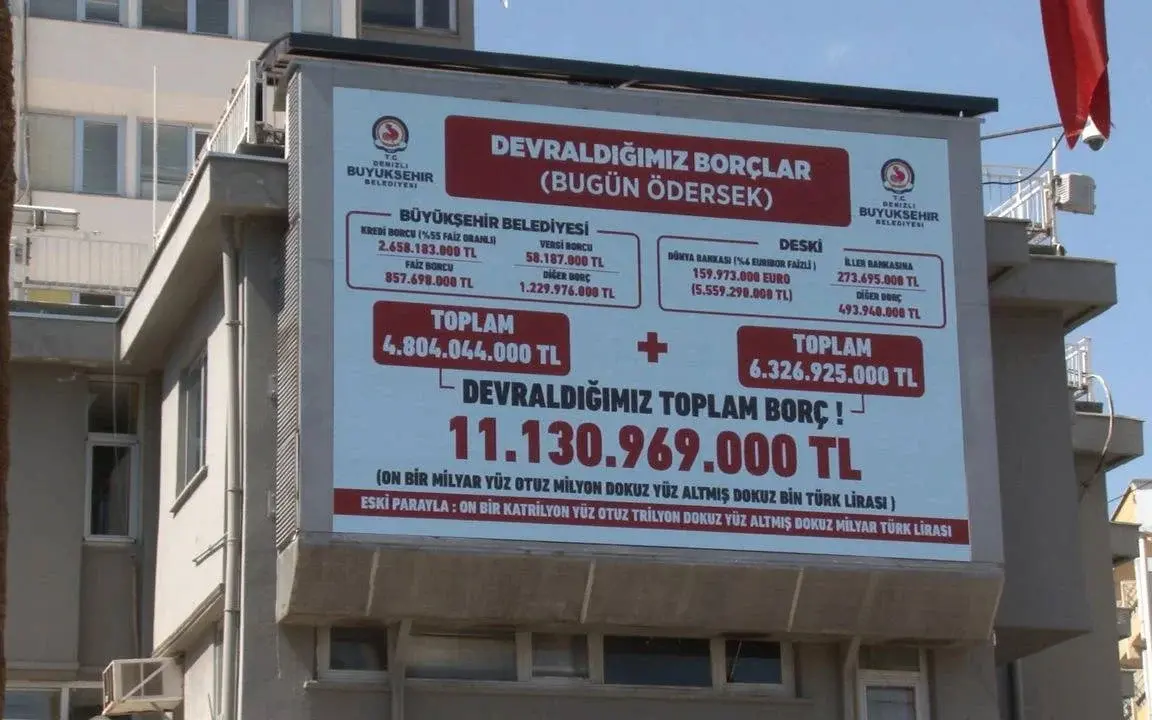

Bülent Nuri Çavuşoğlu, the newly elected mayor of the southwestern city of Denizli, had a banner prepared displaying the debt inherited from the previous administration of Osman Zolan from the ruling Justice and Development Party (AKP).

According to the displayed figures, the debt of Denizli Metropolitan Municipality amounts to 11.13 billion Turkish liras (about $347 million). Of this total, 58.18 million liras consist of tax debt.

The Court of Accounts, the top government accounting body, specifically highlighted the municipality's tax debt in its 2022 audit report. Despite having sufficient cash reserves, the municipality failed to pay its tax debts on time, resulting in the application of late payment interest.

The Court of Accounts categorized this as a public loss, stating, "If late payment interest is incurred due to intent, fault, or negligence, the amount paid will be considered an overpayment and classified as a public loss."

Instead of pay off its tax debts and other obligations on time, the municipality accumulated tax debts and paid them at certain intervals through property transfers to the treasury, according to the audit report.

This practice, which is not beneficial for both parties, should be discontinued, and tax debts should be paid on time to the extent that financial resources allow, the Court of Accounts concluded.

"Inappropriate for a publis institution"

Intentionally postponing tax debts based on profitability considerations does not seem appropriate for a public institution as it should “set an example in preserving the legal order and ensuring that citizens and private organizations comply with the laws,” the audit report further notes.

“It is a fact that resources are extremely limited, and sometimes inadequate, for the execution of municipal services. However, ensuring resource efficiency, rather than non-payment of other public receivables such as taxes, is the way to sustain services. If this practice becomes more widespread, there is a risk of adversely affecting the balance of public finances.

“In conclusion, given the reasons stated, it is considered highly important for the municipality to pay its tax debts on time, even though the current practice may seem profitable for the institution.” (HA/VK)