Click to read the article in Turkish

In Türkiye, people who have a labor contract that fixes their gross wage are increasingly surprised and disappointed when receiving their salaries towards the end of the year. This was already the case for long, but now it is true for all months in the second half of the year or for some 'highly paid' even starting from February on.

People see that their net salary is shrinking every month.

And why is this? It is because the tax brackets are kept very low, not increased in parallel with the inflation rate or the rate of rise of the wages. So higher and higher taxes are collected from the wages of employees, which is also true for low income small businesses.

Taking the example of an employee whose gross wage is 20,000 lira again, the income tax deducted from this wage amounts to 38,475 lira a year. So for two months a year such an employee is working only for taxes.

"An intentional policy"

Trade unions have been criticizing this for long and they are demanding that tax brackets should be increased.

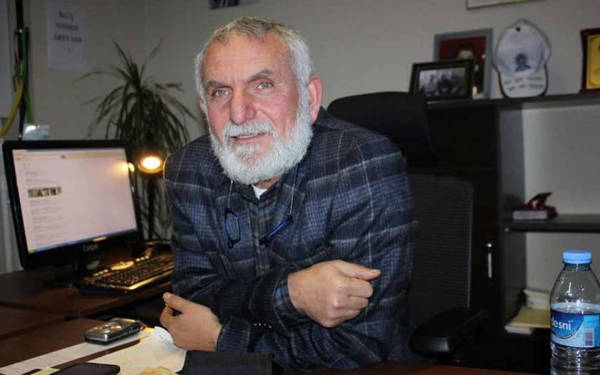

Üzeyir Ataman, an official of the Lastik-İş trade union (Petroleum, Chemical and Rubber Industry Workers' Union) who specialize on justice in income and wage increase models, says that this tax policy is intentional and that it has been continuing for more than 40 years.

"The state is on one side and the employers are on the other side of this phenomenon," says Ataman and adds, "For the last 40 years taxes cut from employees have been transferred to the public and to the employers as funds.This is the truth of the matter."

"If we take 1978 as year zero ... today the minimum wage should be 23,000 lira. But it is 6,471 lira at the moment.

"The same can be said in relation to the tax brackets. The first tax bracket is 32,000 lira at the moment but it would be 200,000 lira if the income tax brackets were increased at the same rate with inflation and the rate of rise of national income. The current tax brackets are causing the tax burden on employees to be extraordinarily high. People have the same income but they are paying more and more taxes and Türkiye has been implementing this model for many years."

Income tax brackets• 15 percent for up to 32,000 lira • 4,800 lira for 32,000 lira of 70,000 lira, and 20 percent for the rest • 12,400 lira for 70,000 lira of 170,000 lira, and 27 percent for the rest • 39,400 lira for 170,000 lira of 880,000 lira, and 35 percent for the rest • 287,900 lira for 880,000 lira of incomes over 880,000 lira, and 40 percent for the rest |

.jpg)