* Photo: Central Bank

Click to read the article in Turkish

The Central Bank's policy rate cut by 100 basis points (from 15 percent to 14 percent) yesterday (December 16) has led to an uncontrollable increase in exchange rates against the Turkish Lira.

Yesterday's cut in the policy rate, or the one-week repo auction rate, has marked the fourth cut since Naci Ağbal, the then Governor of the Central Bank, was removed from office on March 20, 2021.

First, the policy rate was cut from 19 to 18 percent in September 2021; then, it was reduced to 16 percent in October and 15 percent in November.

With every reduction in the policy rate, the Turkish Lira lost value against foreign exchanges and the gold prices increased. The depreciation of the Turkish Lira has come to such an extent that the total loss of value since September 23, 2021 has hit almost 100 percent.

When this news report was being written at around 5 pm local time in Turkey on December 17, the exchange rate of the US Dollar against the Turkish Lira was 16.84. This rate saw 17.14 Turkish Lira during the day. On September 20, 1 US Dollar was 8.64 Turkish Lira.

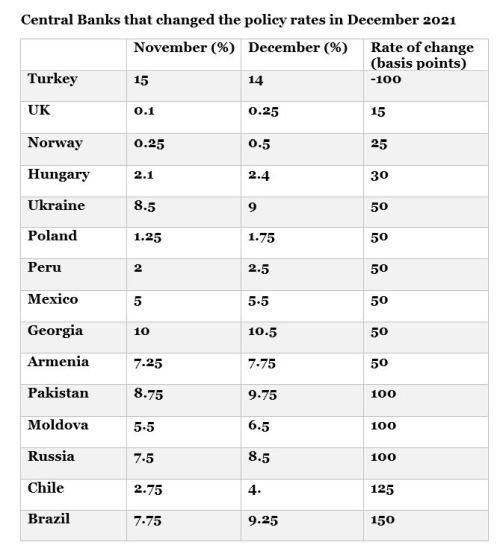

But what have the central banks of other countries done in the face of inflation pressure? The answer is as follows:

In December 2021, 14 central banks increased their policy rates. The central banks of other countries kept the rates unchanged.

While some central banks in Europe have introduced interest rate hikes by nearly 300 basis points since September, the Central Bank of Turkey is the only central bank that has cut the policy rate.

Moreover, despite these policy rate cuts, the policy rate in Turkey is still one of the highest when compared to other countries.

The countries where the policy rates are higher than Turkey are as follows: Zimbabwe (60 percent), Venezuela (56.86 percent), Argentina (38 percent), Yemen (27 percent), Angola (20 percent), Liberia (20 percent), Iran (18 percent), Sudan (17.10 percent) ), Haiti (17 percent), Afghanistan (15 percent), South Sudan (15 percent) and Ghana (14.50 percent).

Inflation is the reason for interest rate hike

Increasing the policy rate from 7.5 to 8.5 percent today (December 17), the Central Bank of Russia signalled that it might increase the policy rate at one more meeting. As the reason for the policy rate hike, the Central Bank of Russia referred to the inflation pressure. Following this decision, the Ruble has gained value against foreign exchanges.

Yesterday, the policy rate was also increased in the United Kingdom (UK) amid inflation pressure and with the countrywide inflation topping 5 percent. It has increased the rate from 0.1 to 0.25 percent. Similarly, Norway, another European country, increased its policy rate. The Central Bank of the country has increased the policy rate from 0.25 to 0.50 percent.

Brazil has increased its policy rate by 725 basis points in total since last March. The policy rate currently stands at 9.25 percent in the country.

Central Bank's course of policy rate changesIn the period when Central Bank Governor Murat Çetinkaya was removed from office on July 6, 2019 and Murat Uysal was appointed in his place

In the period when Murat Uysal was removed from office as the Central Bank Governor and Naci Ağbal was appointed in his place

In the period when Naci Ağbal was removed from office on March 20, 2021 and Şahap Kavcıoğlu was appointed in his place

* In the months that are not indicated in this table, the policy rate was kept unchanged (The Monetary Policy Committee of the Central Bank convenes every month). |

(HA/SD)

-132.jpg)