Photo: AA/File

Click to read the article in Turkish

*This article was published in BirGün newspaper on May 3 and translated into English by bianet editors.

With the so-called full lockdown that covers the period from April 30 to May 17, the debate on cash support for those who lost their businesses and income has flared up again. It is clear that this lockdown is not a total closure. According to the estimates of the Confederation of Progressive Trade Unions of Turkey's Research Center (DİSK-AR), more than 60 percent of employment is exempt from lockdown. Still, millions of employees will lose jobs and income because of this shutdown. How will they live in the period of closure, how will they support themselves? This is the focus of the discussion.

I'll tell you what is going to happen: Registered workers will be forced to unpaid leave and will support themselves and their families for 50 TL per day. Unregistered workers will not receive any support. The support given to the shopkeepers will remain to be a drop in the bucket. In the new closure period, social policy regarding the pandemic is the same old story!

The spear does not fit in the sack

What is surprising is the beginning of an official disinformation campaign (dirty and distorted information) in this field while Turkey is at the end of the list among countries that provide direct and unrequited cash support to citizens during the pandemic. Anadolu Agency (AA), which should be a public news agency and should convey objective information to the public, published some unbelievable news on May 1, 2021.

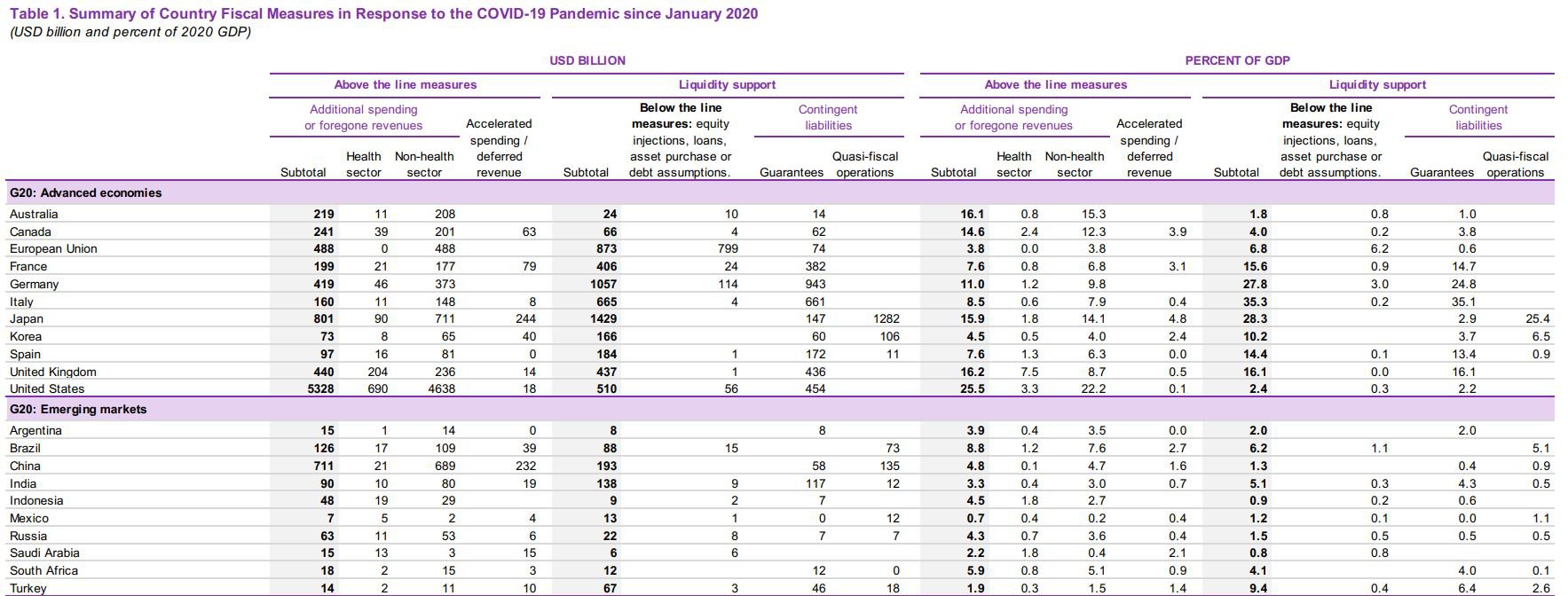

The article titled "Turkey left the giants behind with liquidity support" states, "While Turkey's liquidity support rate was 9.4 percent of its GDP, the country closest to Turkey in the same category was Brazil with 6.2 percent. China remained at 1.3 percent and Russia at 1.5 percent." The data on which this incredible news is based was the IMF's April 2021 Fiscal Monitor: Database of Country Fiscal Measures in Response to the COVID-19 Pandemic. This report, published by the IMF periodically, is a database on the financial measures taken by countries against the Covid-19 outbreak.

CLICK - Turkey ranks last among OECD countries in financial support for citizens during pandemic

CLICK - IMF Fiscal Monitor Database 2021

This news article, in which the principles of objective journalism have been trampled, is considered as a candidate to be taught at a journalism course. It is not possible to come across such a report in any reputable public news agency in the world. Because the article has considered one of the two basic types of fiscal measures included separately in the IMF report while ignoring the other. It has been understood that the article covers up a part of the report with a conscious choice. It is possible to say that this article of AA is a propaganda text far from objective reporting.

What is even more strange is that this article was presented by a former Minister of Labor and Social Security with a social policy formation as "IMF has responded to those who ignore the successful struggle of our country, its works, and supports and who slander them with perceptions." Apparently, the former minister thought that the manipulation of AA was real!

Turkey is among the countries with the least cash support

Let's explain the facts one by one. IMF's fiscal measures database against Covid-19 comprises two parts. The IMF divides fiscal measures into two during the pandemic period. The first is the additional spending and forgone revenue. In this context, besides non-cash supports, forgone taxes and pandemic healthcare expenditures are also included. The IMF uses this as the primary criterion. As a matter of fact, the IMF is based on direct non-refundable cash supports on the world map published on the subject.

The second type of fiscal measure is called liquidity support. We can briefly express this as equity, loans, and guarantees. Apparently, AA tried to offer liquidity supports as cash support! However, there is a world of difference among these. The cash support provided to the citizen is a free and immediately expendable resource. liquidity support means deferment of debt, debt with interest again. These debts are not wiped off, the interests are charged. The first kind of support is directed towards the citizen and the employee; the other is for the banking system.

The reality that AA is hiding is that Turkey ranks last, along with Mexico, among the G20 and "emerging market" countries in terms of direct cash support to its citizens. But at liquidity support (borrowing, interest loan), is at the forefront. Turkey, which has failed the class in direct and unrequited cash support to its people, is in the first place in debt during the pandemic period. How will these loans and interests be paid? Who cares what those who cannot pay will do. Those who cannot pay commit suicide. It is forgotten after three days. Who's gone is gone, the debts are collected from the remaining providers somehow!

According to the economist Nazır Kapusuz, the number of individual loan borrowers increased from 17 million in March 2020 to 34 million in March 2021. Every adult walking down the street is in debt to banks. 7 million people took out loans for the first time in their lives between April and July 2020 alone. Here is Turkey's strategy to combat the pandemic.

As Table 1 shows, Turkey ranks low in direct cash support and expenditures in the world. Turkey, along with Mexico, ranks last in the amount of cash support and spending among the G20 countries. The ratio of direct cash support and expenditures, including healthcare, to GDP in developed economies, is 16.4 percent, while in developing economies it is 4 percent, this rate drops to 1.9 percent in Turkey. Therefore, it is out of the question for Turkey to overtake the "giants", as AA distorts it. Moreover, Turkey has provided cash support far below the countries in its class such as Spain, South Africa, Indonesia, and Korea.

According to Table 1, while many countries and country groups put the weight on cash and direct support during the pandemic and prefer to put money in the pockets of the citizens, the debt of the citizens in Turkey has been postponed, re-borrowed and banks have been supported. While cash supports in developed economies are 45 percent more than liquidity supports and 60 percent more in developing economies, in Turkey, on the contrary, cash supports remained below 20 percent of total supports.

Debt, not cash

When we look at the distribution of cash and liquidity supports in Turkey, we are faced with a rather skewed picture. As seen in Table 2, the total cash support and expenditures related to Covid-19 in Turkey is 95 billion TL. Of this expenditure, 16.8 billion TL is composed of health expenditures and 29.4 billion TL from foregone tax revenues. Thus, direct unrequited cash transfers fall to 48.6 billion TL. 40.3 billion of this amount were provided by the Unemployment Insurance Fund. Social assistance to households, on the other hand, remains at 8.3 billion. Thus, while the capital support given to banks and companies reached 21 billion TL, only 8.3 billion support has been given to households.

In the fight against Covid-19 in Turkey, it has been preferred to increase and delay the debt of the citizens instead of putting money in their pockets. Thus, in the Covid-19 period, citizens were preferred to finance their decreasing income with debt. 83.3 percent of the total fiscal measure amount is reserved for debt deferral, new debt, loan and capital support to banks/companies. The opposite has been done in the world.

In the Covid-19 period, the government preferred to make citizens indebted instead of putting money in their pockets, which has been the case in many countries of the world. This approach has nothing to do with the social state. The main criterion is how much money you put in the pocket of the citizen during the pandemic. Truth hurts. It is not possible to cover up this fact with the distorted news of AA. (AÇ/NÖ/DCE/VK)