Click to read the article in Turkish

FinCEN Files is a new leak including 2,100 suspicious activity reports (SAR), which show dirty money movements around the world.

The documents were first leaked to Buzzfeed news and then shared with the International Consortium of Investigative Journalists (ICIJ), which had also published the Panama Papers and Paradise Papers in 2016 and 2017, respectively.

The new leak shows how dirty money is laundered through some of the world's largest banks and how financial criminals use corporations to conceal their activities.

The documents reportedly detail 2 trillion US dollars of potentially corrupt transactions.

Files related to Turkey

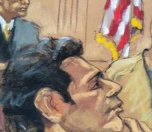

Activities of Reza Zarrab, a businessperson with a dual citizenship of Turkey and Iran, are also included in the leaked files.

In 2017, Zarrab pleaded guilty in a US court to helping evade Iran sanctions through Turkey's state-owned Halkbank. He admitted that he bribed government officials in Turkey and Halkbank executives to allow Iran to use proceeds from oil and gas sales to buy gold.

Halkbank is also on trial in a separate case for evading Iran sanctions.

According to the FinCEN files, three months after Zarrab was arrested in the US in 2016, Standard Chartered Bank filed several suspicious activity reports as part of one SAR on a decade of bank transactions involving Zarrab and other entities.

In October, Standard Chartered filed a series of reports as part of another SAR, listing 133 million dollars worth of transactions made by entities the bank had tied to Zarrab's network, says the ICIJ report. The bank said it filed those reports "for continued transactional activity related to a multi-jurisdictional investigation of possible money laundering and other offenses related to Reza Zarrab."

Included in Standard Chartered's suspicious activity reports were more than 87 million dollars in transfers taking place between January and September 2016 and involving Rona Döviz, a currency exchange company that Zarrab allegedly used for his earlier gas-for-gold scheme.

The company didn't respond to a request for comment from ICIJ and Deutsche Welle's Turkish service. Standard Chartered didn't indicate that the flagged 2016 Rona Döviz transactions were linked to Zarrab's gas-for-gold scheme, which shifted to a disguised food purchases scheme in 2013, according to US prosecutors.

Separately, three years before Zarrab's U.S. arrest, the Bank of New York Mellon had flagged more than 59 million dollars in transactions covering the years 2011 to 2013 involving Güneş General Trading, one of the companies named as a co-conspirator but not charged in the 2016 US indictment of Zarrab, according to the leaked documents.

SARs reflect the concerns of compliance officers and are not necessarily indicative of criminal conduct or other wrongdoing. Zarrab, contacted through US lawyers, did not comment, ICIJ reported.

Trials of Zarrab and HalkbankReza Zarrab, a businessperson with dual citizenship of Iran and Turkey, was taken into custody at Miami Airport on March 19, 2016. He was remanded in custody on March 21. He was charged with violating sanctions against Iran, money laundering, "conspiracy against the US," and defrauding US banks. During Zarrab's trial, Turkey sent a diplomatic note to the US embassy, requesting information about the businessperson as it was not able to hear from Zarrab and was concerned about his life safety. As part of the same investigation, Hakan Atilla, the then deputy general manager of Halkbank, was detained at New York JFK Airport on March 29, 2017. He was also remanded in custody shortly after. The court combined the cases of Atilla and Zarrab in April 2017. In his first hearing on April 27, Zarrab facing up to 95 years of imprisonment denied the accusations of conspiring to evade US sanctions against Iran, money laundering and bank fraud. Facing a prison sentence of up to 90 years and a 50 million US dollars fine, Zarrab became a confessor in October 2017. He admitted that he used Halkbank to trade gold for natural gas. After Zarrab's confession, Attila remained the sole defendant in the trial. In September 2017, then Minister of Economy Zafer Çağlayan, former Halkbank General Director Süleyman Aslan, Halkbank Deputy General Director in Charge of International Operations Levent Balkan and Zarrab's worker Abdullah Happani were added as defendants. On October 26, Zarrab pleaded guilty and admitted that he bribed then Minister of Economy Zafer Çağlayan and explained the business traffic he followed to evade sanctions. On January 3, 2018, jury members found Atilla guilty of five of six charges. He was sentenced to 32 months in prison on May 16, 2018. After completing his sentence, Attila returned to Turkey on July 24, 2019. In October 2019, he was appointed as the director-general of Borsa İstanbul stock exchange. On October 15, 2019, US prosecutors charged Halkbank with six offenses: defraud the US, conspiracy to violate the International Emergency Economic Powers Act, bank fraud, conspiracy to commit bank fraud, money laundering and conspiracy to commit money laundering. The trial is still underway. |

(PT/VK)

132.jpg)